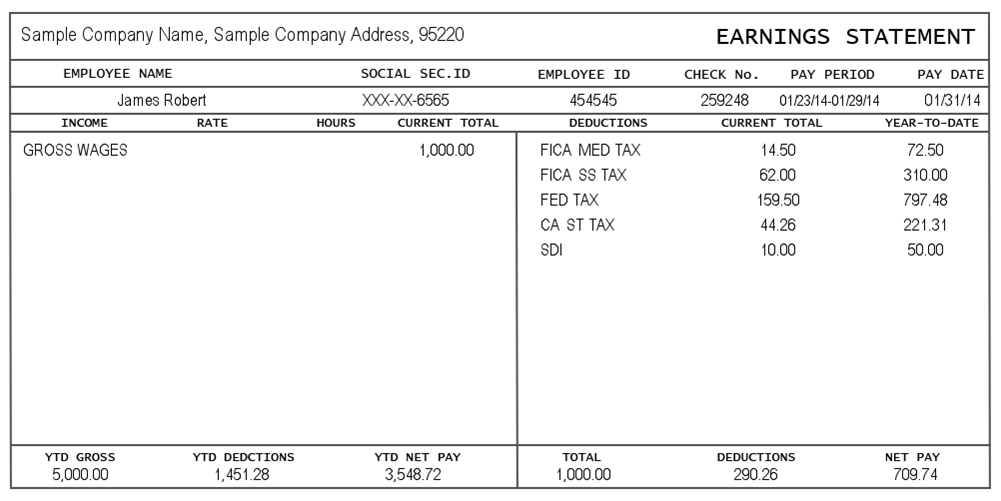

- Evidence of money (1099s, W-2s, or tax models)

- An acceptable financial obligation-to-earnings ratio (most finance companies come across below 43%, so that the decrease your bills, the greater)

- Credit score (A 700 is a little lower than very financial institutions would like, you could beat it if you can show earnings and has actually a minimal DTI)

A traditional financial loan to get this new property is separate out of a mortgage getting structure on residential property. If you wish to get build financial support on exact same financial, you will need to possess construction arrangements, costs points, and builders already set up.

Unless you have quick plans to make toward brand new house, it may be difficult locate financial support. To beat which difficulty, you may need to impede the purchase or take for you personally to build-up your credit rating. You can even decrease your DTI by boosting your earnings or settling bills.

Security Mortgage

A house collateral loan tends to be a selection for buyers who actually have security collected in their house otherwise toward another assets. Banking institutions will often have a lot fewer criteria getting security funds than for conventional funds, which means this would be a selection for a person with an excellent 700 credit score.

Whenever trying to get a collateral loan, you still need to submit proof money and your DTI. While the mortgage spends the security of your property since the equity, you’ll likely not need to generate a down payment with the the fresh homes.

Vendor Investment

In the event the a purchaser cannot rating investment out of a lender with the credit rating, it may be you are able to to get vendor capital. If the a vendor is very encouraged to sell their property, they may promote capital on consumer.

In cases like this, it is important into provider in addition to consumer to draw up an appropriate offer you to contours the program towards costs. A different assessment of your property are recommended if the a purchaser gets provider investment, but both sides need solicitors look over the fresh agreements.

Whenever you are merchant financing enjoys loose conditions than bank financial support, the buyer have a tendency to still have to confirm that they’ll repay the mortgage. The customer may prefer to bring:

- Evidence of income

- Design plans on land

- Reputation of a good credit score

- Emails off recommendation regarding earlier loan providers

There isn’t any hard-and-fast laws as to what need so you can secure seller money. It is as much as owner in order to veterinarian buyers and view if they’re safe financing the acquisition. For almost all suppliers, credit history isnt difficulty as long as the buyer can show proof earnings. Other vendors get installment loans online direct lenders South Carolina undertake characters away from recommendation out of past loan providers inside the place regarding a credit rating.

There are several different kinds of property loans one to a purchaser may be eligible for. When you find yourself a great 700 credit score isnt fundamentally a boundary to to buy belongings, it can be more complicated on how best to be eligible for specific kind of home money.

Increased Belongings Mortgage

These mortgage is for homes one to currently has access in order to courses, liquid, and you may strength. With energy outlines currently in position makes it much simpler and more affordable to construct into the belongings. Increased residential property is even more expensive than many other particular home.

- Build a down-payment of at least 20%

- Let you know proof of money

Since the increased property provides the very possible, its safest to have customers that have a 700 credit score so you’re able to score that loan to have enhanced residential property. To safe funding, customers can be prepared which have structure preparations and also their builders all of the lined up.