You are able to do all you need online which have Friend Bank

Friend Bank’s second IRA giving is the IRA Improve Price Video game, similar to the typical Improve Rate Cd. New IRA type in addition to happens since the a two- or five-season term. For those who finance your IRA Cd into the very first ninety days, the lending company provides you with an informed rates to suit your title and you will equilibrium level. You can also have the opportunity to boost you to definitely rate just after over your several-seasons label otherwise twice more no credit check loans Lawrence your 4-seasons identity, if the pricing along with your harmony raise.

Notice try compounded each day, and merely deal with fees as the a penalty to possess early withdrawal. This, along with laws and regulations close deposits and distributions are exactly the same once the the standard Improve your Rates Computer game.

Fundamentally, you can search on the Ally Lender IRA On the web Family savings. Because the it is not an effective Cd, there are not any lay big date restrictions because of it IRA. Yet not, you are nevertheless limited by half dozen outbound transfers for each and every declaration course due to federal laws. You can face punishment fees for folks who surpass which maximum. Luckily for us, Friend Bank wouldn’t fees people costs to your repairs of your own membership. Nevertheless they hope zero hidden charges. New costs that you might pick might be as a result of the fresh new pursuing the deals: returned put item, overdraft items reduced or came back, a lot of deals, expedited beginning, outbound residential cables and you may way too much membership search.

While making a withdrawal out of your IRA On the internet Checking account, you will want to request a shipping away from Friend Financial. This is done often online, to your mobile application or of the contacting the fresh bank’s customer service line. You may discover the shipping means on the web, printing it and you may send it into the.

All of the about three IRA choices render flexible money possibilities, plus Roth and you will traditional IRA rollovers. Each kind is even readily available due to the fact a Roth, September otherwise traditional IRA. Together with, your deposits is actually FDIC-insured doing the new courtroom matter. Which comes in useful since your levels could well be increasing within a powerful rate which have focus compounded every single day.

Creating a robust offers environment encompassing pension plans usually takes more than just starting a keen IRA. Economic advisers makes it possible to part away and you can dig to the field of expenses or other enough time-title savings tips. This new SmartAsset monetary mentor matching equipment is also couple you having upwards to three advisers that suffice your area and certainly will help you that have a monetary bundle. While you are ready to be matched having advisers which will help your with your economic wants, get started now.

In which Do i need to Pick Friend Bank?

Ally Bank is actually a completely online- and you will cellular-founded institution. You can arrive at a realtor either because of the mobile otherwise thanks to an internet talk system. You can even find an estimated waiting day on the website. The company’s financial customers properties arrive 24/eight, while the are the mastercard services.

You can find out in the their various monetary offerings, away from examining account to help you auto loans in order to investing in order to offers levels. You could unlock various profile on the internet and once you’ve an membership, you can jump on indeed there.

When you yourself have one or more account, that is obtainable to you, also. To own users that have any questions, there’s always Ally’s frequently asked questions, or FAQ, part, a pursuit form and contact pointers to possess agents within financial.

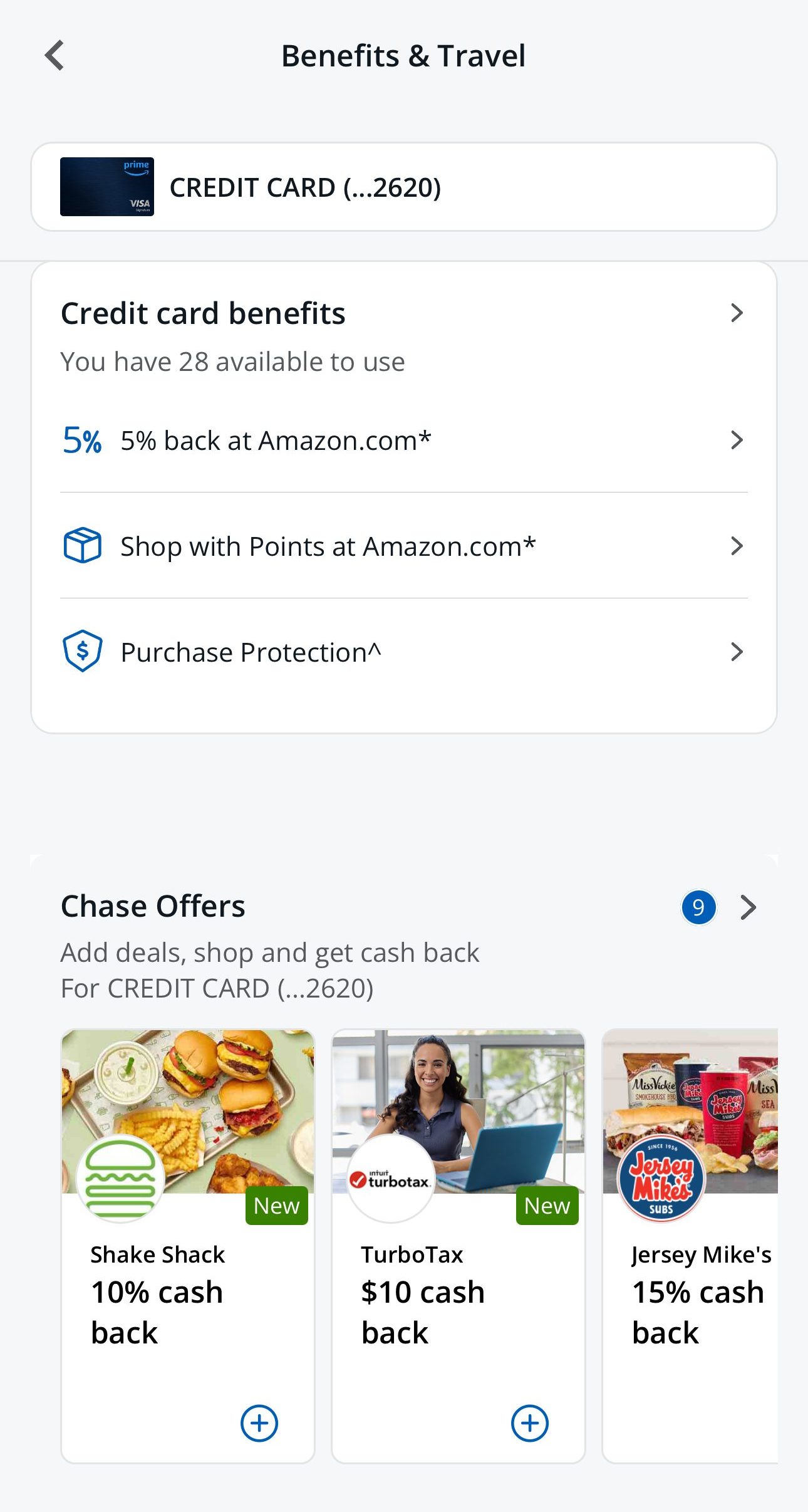

Ally Lender now offers a mobile application so you’re able to their consumers. Highlighted because of the associated visualize, brand new mobile app enables you to visit your full income, split by for every account. Then you may simply click any kind of membership you are interested in so you can do it because you would on line. You could make costs, deposit money, import funds or simply just check into your balance.