Which done-services lender is developed so you’re able to suffice our very own best patriots; pros, effective army users and their family online personal loans NE unit members. USAA try a combo between a credit partnership therefore will a financial giving aspects of each other. Established in 1922 on the San Antonio, Texas, the business has grown so you can serve at the least 77 billion provider people in this country. USAA is not a freely exchanged providers. Just profiles is actually be involved in the new applications USAA has the benefit of, enabling USAA providing book professionals and you may such the brand new USAA home loan costs.

USAA now offers residential lso are-money cost in fact it is traditional, variable characteristics a whole lot more 66 % of your loans is served about Va finance. The service means the military category; authorities, soldiers as well as their families. Depending on the business, cashouts are smaller or, for those who get a hold of an effective USAA re also-money as you features run into troubles, a loan administrator usually consider your role and you may you can tell you the borrowed funds re also-structuring options. USAA works totally co-processes on the newest government applications.

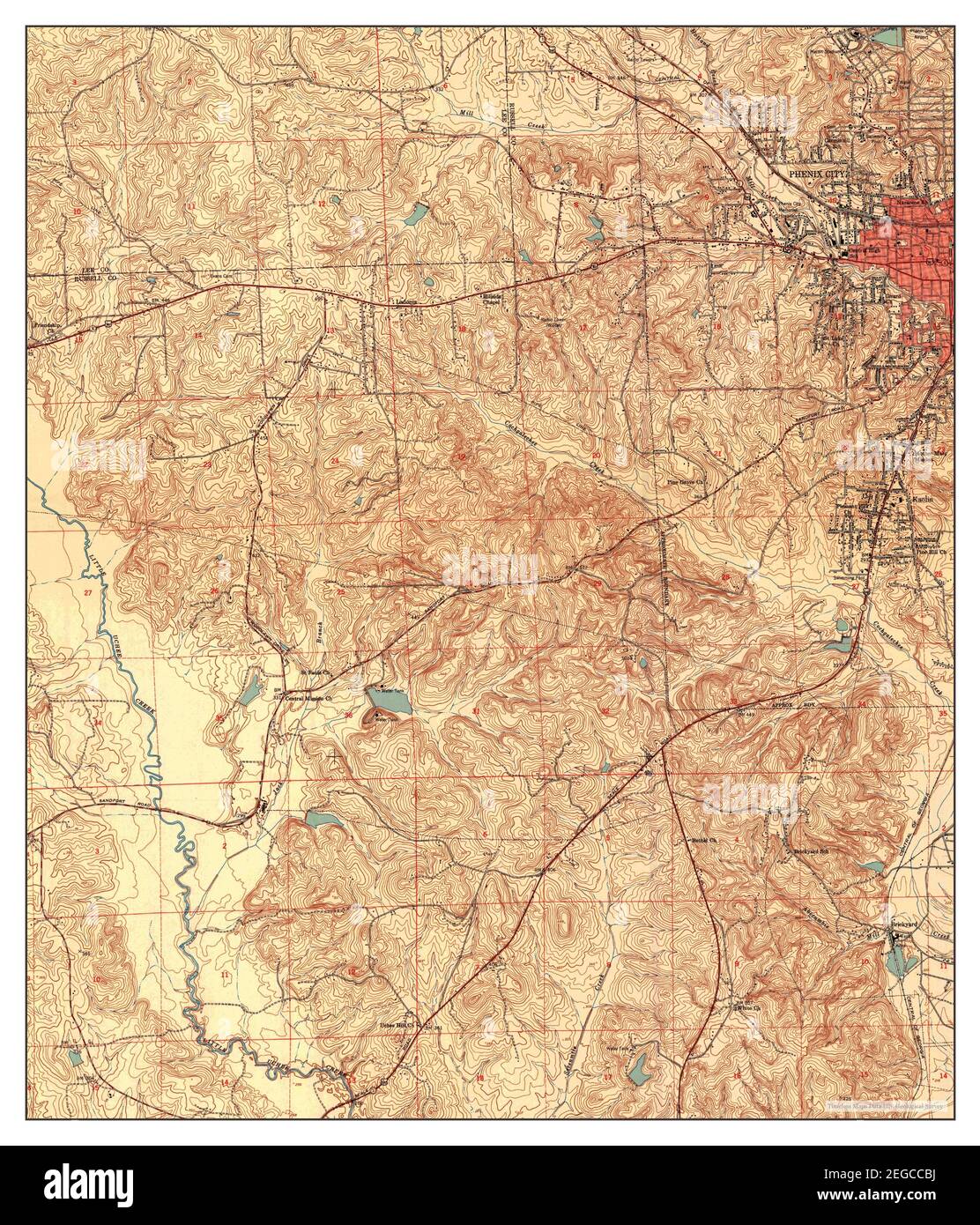

Army, retired and you may effective obligations, and you will household members out-of military workers are permitted USAA home loan refinance pricing (Photo/Pexels)

Refinancing affairs provided by USAA

The loan providers bring numerous factors. Consider every one of USAA’s refinancing speed selection. Currently, USAA household re-money software prohibit security alarm financing and you can home-based protection line of credits (HELOC).

- 30- 12 months fixed rates

- 20-one year repaired rate

- 15- 1 year repaired speed

- 10-year repaired rates

As with any repaired speed fund, the rate your commit to cannot to change across the life of your house investment. A fixed-pricing home loan helps make budgeting to your homeloan payment simpler than just with a varying-speed home loan. USAA economic will set you back also offers terminology ranging from 10 so you’re able to 30-years. Single members of the family investment matter often cap when you look at the the $424,one hundred for every the company restriction. Getting USAA re-finance pricing, view the website personally, otherwise refer to them as with the mobile. Fundamentally, minimal amount borrowed within USAA try $50,one hundred thousand but can wade all the way to $step 3 million. From the repaired-price financial choice at the USAA people would be re-finance starting 95 percent of one’s worth of their property.

Case funds provides a smaller title than just extremely antique fixed-price home loan small print however, come with a tempting bonus. The new reduced words including suggest straight down appeal membership. You to definitely problem of a fees loan Este Paso AR sleeve is the higher monthly premiums that compliment a smaller label.

USAA will not denote new regards to Arm having refinances, like many other issues which have USAA it’s best to have them on mobile. Pre-recognition processes, yet not, is visible for the website: usaa. Just after pre-acceptance is completed and a buy offer is within set, the site candidate is even finish the procedure rates-100 % free of your cell. As with any financial, the interest rate you are able to safer up-better is dependent on your own credit reputation and amount borrowed.

- Virtual assistant money

Review: USAA mortgage can cost you and re-finance affairs

Are a loan provider that suits classification which have army ties, it’s wise one to USAA’s a great suite is largely the USAA Va loan offerings. Over step one / dos away from USAA’s financial cluster is inspired by Virtual assistant loans. T the guy zero-percentage Virtual assistant Interest Remedies Refinance loan (IRRRL) is hard to beat some other loan providers. USAA and you will allows Va borrowers so you’re able to lso are-loans as much as entirely of your worth of their house. USAA formations the Virtual assistant money into the ten-, 15-, 20- and you may 31-year words.