Just how do Canada build their way-out away from construction also provide pressures to alter affordability? That have increasing consult and you can rates of interest putting an excellent wrench during the design preparations, the answer is far from easy.

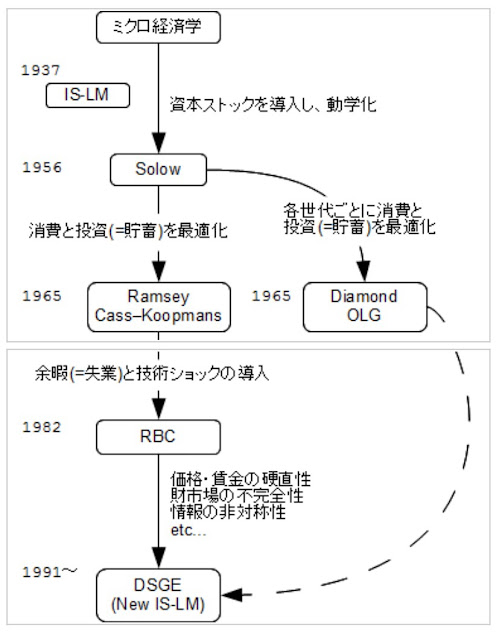

This article examines the important part of private field inside driving housing supply, analyzes the fresh feeling interesting costs into the different varieties of homes, and you will contours prospective a lot of time-identity possibilities that may enhance private-field rely on and inject investment inside the casing advancement.

Canada enjoys surprise need to make a great deal more casing in order to target affordability challenges in lots of Canadian cities. Houses is actually a serious infrastructure toward cost savings, supporting labour freedom and you may ensuring a greater share of income can feel committed to energetic financing.

High barriers so you can broadening casing have through the long-updates pressures away from regulating can cost you and delays. Increasing property also provide might require studies alot more pros and you can boosting efficiency from the invention and structure areas.

The modeling suggests that inside the 2023, higher interest levels reduced homes begins by on 29,000 units (about 10 to 15 %) within the Canada.

The state of property likewise have try described inside our previous Property Supply Statement. They learned that higher interest levels impacted brand new framework out of condominium houses round the all of the nation (aside from Alberta).

We are still alarmed you to definitely starts into the Toronto possess yet so you can reflect an entire effect of high interest levels. If you find yourself delayed aftereffects of large cost might remain, the brand new move to all the way down interest levels is always to activate property likewise have more next year. Given this possibility, services conducive so you can support far more housing also provide need to continue.

The personal markets is actually main to increasing also have and you can boosting cost

Brief traders promote the majority of the money to create condo renting. Designers improve money from prospective consumers which could possibly get occupy people equipment otherwise lease them away. People need certainly to borrow funds, perhaps not because of their down payment, but most likely to cover devices on completion.

Therefore, new readiness from individual customers and you may dealers so you’re able to acquire commonly dictate the construction regarding condominium structures. Designers have a tendency to progress making use of their construction if the around 70% out of leases is presold. Subsequently, condo leases are extremely a serious source of rental availability inside Toronto and Vancouver.

Higher buyers are critical to supplying financing for strengthening high multi-storey purpose-founded rental structures. While the multi-million-money construction costs will eventually end up being included in renters through the years, people upfront expenditures have to be paid just before revenues start to move from inside the.

To handle this time mismatch, loan providers step up in debt to fit newest will set you back having coming profits. But it capital mechanism helps to make the choice away from https://paydayloancolorado.net/hayden/ whether or not to just do it having structure even more responsive to rates of interest and depending for the if creditors are able to bring credit.

The latest susceptibility away from personal people for the homes – if small or large – in order to macroeconomic action shows that making certain a lot of time-title persisted disperse from financial support financing is important so you can broadening property likewise have.

What do the data say?

Condo begins was sensitive to interest levels you to definitely people deal with, whenever you are local rental starts are responsive to rates you to corporate dealers deal with. Longer-identity mortgages experienced by private people and brief-term thread prices, likely to getting experienced because of the corporate borrowers, improved by nearly four fee points.

In the model you will find built to address how much cash houses Canada need, i estimate your current increase in interest levels – making out most other changes in the newest benefit – resulted in 31,000 a lot fewer construction begins, of an entire yearly average of approximately 250,000.

The effect of interest costs are offset of the most other economic products and you will bodies guidelines to support design out-of rental buildings round the Canada. Framework stayed stronger than expected inside the Alberta due to a powerful economy.

Long-title implications to help you securing Canada’s houses supply

Over the past 2 decades, Canada has established an architectural deficit during the property supply that will simply be treated courtesy comprehensive capital because of the personal markets. To your personal sector bringing approximately 95 % away from casing when you look at the Canada, this is especially valid to address brand new affordability pressures of middle-group, if or not for rental and for control.

Unfortunately, this also form relying on a market that is affected by changes in the fresh new economy, notably changes in rates. So, all of the degrees of bodies must ensure that individual market is also create normally property that one may in the event the heading was a beneficial, and you will rates try lower.

Used, it means improving the responsiveness of the houses program, including thanks to smaller recognition moments and shorter suspicion. Frameworks might need to be built to verify structure continues even when rates is large.

Recently government entities revealed it might put up a functional classification to look at domestic funding solutions for Canadian retirement loans. Development ways a lot of time-term diligent financing would be dedicated to appointment Canada’s long-title homes shortfall tend to clearly make a difference.

Fundamentally, building another where all the Canadians gain access to housing one to was affordable demands a collaborative work. Whenever you are highest rates of interest nevertheless establish a short-title difficulty, they provide important learnings for people every. We must consider an effective way to empower the private market regarding economic course if we are to address the property drama.

Aled ab Iorwerth coordinates a varied federal people of boffins and you will experts who happen to be investigating impediments so you’re able to housing also provide and prospective choices.