It’s December 2012 and it’s been over per year and a half which have good results. You have decided not to ever tune in as you already know what exactly is the brand new martyr method as well as consequences. After you contour so it aside, you’ll learn where wear’t need place your money and time as well as https://mrbetlogin.com/alice-adventure/ how they can be wind up if you. Inside the exchange, it applies similarly, since the key to Martingale steps if you trading is to increase the size of the position while the speed gets into the opposite assistance. Change unlike increasing can increase the brand new choice size by 1.1, 1.2, 1.step three A variety of versions and you may situations even if while we tend to find underneath the consequences normally have the same avoid. Because of it strategy, a bona-fide prevent losses acquisition isn’t necessary; as an alternative, you’ll you desire a psychological one as the exchange will continue rather than closing anytime it goes wrong.

As you may well know, the market or people economic market for you to definitely number can be not neatly quicker for some easy chances number. It’s far less straightforward as a coin flip otherwise gaming on the an excellent roulette desk. After you eventually winnings, the cash you have made from this victory is going to be adequate to recoup all earlier losings sustained plus generate a good money. Once the first winnings, you could log off the new desk along with your profit otherwise gamble once more, starting with the lowest matter. A great real life illustration of the massive development that can be realized away from an Anti-Martingale trade strategy is the brand new Larry Williams tale.

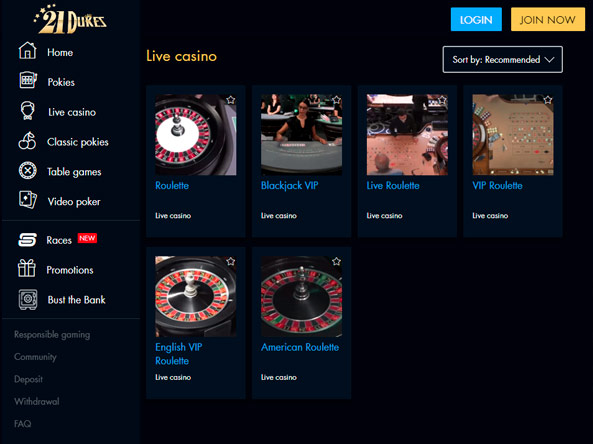

Additionally, the brand new Martingale strategy doesn’t make up exterior issues that will dictate stock cost, such as economic climates, geopolitical incidents, otherwise community style. In other words, they does not have a basic investigation of one’s stock by itself plus the field where it works which could or even become an incredibly important factor away from informal trading. Today, the new Martingale technique is mainly used and you will used inside gaming, particularly in game with a good 50/50 threat of effective, such as flipping a coin otherwise gaming to your purple/black or even/odd inside the roulette.

- Investors is always to meticulously consider the exposure threshold and you will trading carries expectations prior to using this method in the stock trading.

- Particularly, the newest investor increases the new money on every then change to recuperate past losings and obtain money equal to the initial risk.

- Martingale trade now offers self-reliance by permitting deals in the individuals exchange rate membership with assorted exchange models round the additional areas.

- Whenever change by using the doubling off method, you simply twice as much 2nd admission rates unless you achieve your goal otherwise go out address.

Contrasting the new Martingale Means along with other Steps

To discover the money to possess another trade, pages can also be borrow money from an exchange to improve their reputation in the business. State Investor A great spends $5 within the an investment position but suffers a loss. Instead of taking his loss and withdrawing his condition totally, the guy spends twice as much.

The newest Martingale Strategy outlines the origins back to 18th-millennium France. Lévy’s love for possibilities and statistics provided your so you can develop a good strategy who would provide gamblers an edge within their bets. The strategy is superb if you’re not particular when indeed there would be an excellent pullback for you to enter the business. You should buy during the high rates and if the brand new trend keeps, you create huge winnings.

The brand new “Repaired Percentage” Dance: Incorporating Beat in order to The forex market

A properly-structured package should include clear desires, a robust risk management strategy, field investigation process, and you can a posture sizing program to enhance exchange overall performance. This will help traders stick to tune and then make told conclusion, actually through the unstable business conditions. For a position with the same opportunities, such a money throw, there are two feedback on exactly how to proportions a swap.

Simple tips to Trading the new Bearish Engulfing Development

From your talk, it’s clear this method is on the risk-candidates and never all the individual. Therefore such buyers will benefit out of this means by the exchange which have people finest agent including Quotex. As previously mentioned a lot more than, an informed website name for it strategy might possibly be where currency sets would be the asset category. Very, a good Quotex trader whom actively spends this strategy while you are trade money pairs often entail minimum likelihood of shedding entire money. But, that doesn’t limit the buyer from examining almost every other advantage classes on the Quotex. Therefore, if a trader uses the brand new Martingale approach instead of security measures acquiring favorable results is not easy.

Martingale trading solutions are preferred in the Fx automated change because it’s quite simple in order to do an enthusiastic expert coach that would exchange using martingale. And, the system appears very interesting and you may profitable to help you of many Forex novices. The techniques is based on the concept that it takes only one to a great hands making a king’s ransom. Historical research recommend that such as a method can work simply for quick menstruation. One of several choices investors face is whether to fool around with totally free fx spiders otherwise invest in paid off of them. This website tend to speak about the differences ranging from free and you can paid off fx crawlers and you may stress as to why going for a premium fx robot try often the better choice.

With quite a few tons, attention earnings can be hugely extremely important and relieve risk. With a high quantity of plenty the brand new membership may go bankrupt that have a tiny flow. The concept here’s to help you split the newest chart to your grids and you can lay purchase and product sales requests inside for each point, to the aim of to be able to gain benefit from the escalation in the marketplace.

The new Martingale EA: A word-of Warning: The risks away from Martingale Approach

Because it is according to playing and you will possibilities, it’s no surprise the new martingale strategy has its own origins inside betting. The newest Anti-Martingale based method is the most used method for allocating exposure in this an investments membership. Traders will have to great-song the methods to meet its particular desires, still, it’s definitely worth the effort to accomplish this. The new Anti-Martingale means will not have a few of the restrictions one a great Martingale founded strategy is suffering from.

The brand new Martingale approach will act as a greatest higher-chance change strategy found in individuals monetary places as well as Forex and you may brings. The strategy is dependant on the principle away from increasing your own trading size after every losses to recoup the past losses inside a single exchange. Even though this means might have been common, it has threats, and you also need to put it to use meticulously. Within our post, we’ll discuss the Martingale means in detail and understand how you can use it in order to trade fx.

The brand new anti-Martingale, or opposite Martingale, system is a trading and investing methods which involves halving a wager for each time there’s a swap losses and you may doubling it when there is certainly an increase. This technique is the opposite of your own Martingale program, whereby an investor (otherwise gambler) doubles upon a losing bet and you will halves an absolute wager. Even with its dangers, the brand new Martingale Approach remains used by lots of fx traders today. It’s seen as a top-chance, high-award means which can potentially result in high profits in the event the performed precisely. However, what is important to have traders to carefully think about the threats inside and also to has a strong risk administration package positioned. Forex trading are an elaborate and you will vibrant market which provides many potential to possess people making winnings.

Therefore, exactly why do someone pertain betting video game-based solutions to financial places? This really is a valid matter, particularly considering the secret contrasts ranging from gaming and you will trade. After all, a trader makes better-informed behavior, however, a casino player simply attempts to overcome the odds. Just remember that , the dimensions of the new bet will continue to expand significantly following initial wager. Whenever a burning streak lasts for too long, you may need to undertake the compound losings and you can quickly hop out before you could have the opportunity to compensate your losings. Offered this type of risks, the brand new Martingale method is essentially sensed less efficient in the inventory field versus almost every other trading tips.