Yet not, the pace you get hinges on the lending company you select, your revenue, your credit rating, the fresh down payment matter, the borrowed funds label, or other circumstances.

When you get a great USDA loan, you pay a single-time step 1% verify commission and you will a good 0.35% annual payment (charged month-to-month). Having a great Va mortgage, you need to pay an effective Virtual assistant financing commission one to varies from 0.5% to 3.3% of one’s loan amount. Regardless of if you’ve taken a beneficial Va financing in earlier times and the down-payment you create enjoys an impact on the capital payment you pay.

Including, when you’re bringing a Virtual assistant loan for the first time and make a great 5% down payment, you will have to shell out dos.15% as the money commission. If your downpayment grows in order to ten% or more, the new funding payment falls to a single.25%. If you’ve made use of a Virtual assistant mortgage in past times and work out a great 5% down payment to the your brand new Virtual assistant mortgage, you only pay a good 3.3% capital fee, and it minimizes to 1.25% if you make a down-payment from 10% or maybe more.

No matter which kind of loan you have made, you also need to help you account for settlement costs . These could come in the type of https://paydayloanalabama.com/oak-hill/ app charge, loan origination charges, assessment costs, attorney costs, rates secure charge, and you can underwriting costs.

Home loan Insurance rates

This new deposit you create towards the a conventional home loan affects if or not you pay extra to have private home loan insurance coverage (PMI). If your down-payment is less than 20% of your house’s price, you ought to get PMI. That it resides in place until you build no less than 20% equity of your home.

With respect to financial insurance policies, it could are available your USDA loan against. conventional loan review tilts the bill in support of the previous. not, while USDA money don’t need you to definitely shell out even more to own home loan insurance rates , you pay a yearly ensure commission that is generally speaking incorporated on your own month-to-month mortgage repayment. The lender following will pay so it commission toward USDA.

The newest Va financing vs. antique loan evaluation is not all that other to have financial insurance. When you don’t have to spend a lot more having mortgage insurance if you have made a Va financing, you have to pay a financing fee that your lender fees as a portion of your amount borrowed. It is possible to shell out so it in the closure or as part of your monthly mortgage payments.

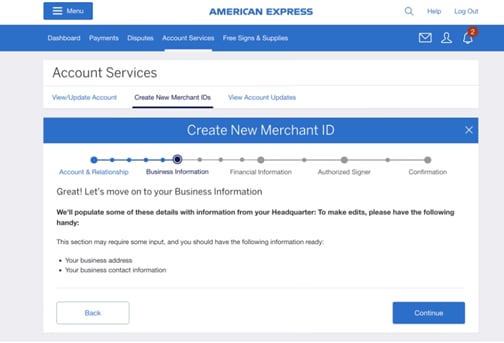

Making an application for a home loan

It is possible to get an effective Virtual assistant financing owing to people lender your get a hold of shortly after bringing a certificate away from Eligibility (COE) , that you might receive on line, thru post, otherwise throughout your bank. If you want to rating a beneficial USDA mortgage, you should curb your research with the department’s set of accepted lenders. You get a bit more lenders from which to choose for many who decide to get a traditional mortgage.

Search Preapproval

Consider this to be shortly after trying to find your ideal domestic, you restrict on a single you to definitely can cost you $750,000. not, when you sign up for home financing, you will find away your meet the requirements in order to obtain just $500,000.Providing preapproved gives you a sign of how much money good bank try ready to give for you and this gives you the ability to select house properly. Along with, a great preapproval ways so you can a vendor your seriously interested in the fresh new techniques and also have the backing of a loan provider.

Keep in mind, whether or not, one a great preapproval does not incorporate a guarantee because your financial would opinion your creditworthiness when creating the fresh new underwriting process as well.