If you were to think positive about your month-to-month homeloan payment estimates, you could begin the application techniques. Here’s what it can feel like out of your earliest contact which have lenders towards closure go out.

- Rating pre-qualified: keep in touch with a number of lenders and you can remark your money to acquire a concept of your ideal mortgage size. You usually do not need to render paperwork of your own funds during this dialogue.

- Search at property: trip land in your spending budget and you can wanted urban area. Choose one you would want to make a deal to your.

- Score pre-approved: publish the house toward lender and ask for pre-acceptance for the financing. This makes your property render more powerful. Attempt to give economic records for the financial (such as for instance tax statements, pay stubs, and you can lender comments) to achieve pre-acceptance.

- Quote to the household: fill out a deal toward homeowner and include their lender’s pre-recognition page.

- Consistently publish economic files towards the financial: attempt to promote reveal image of your finances into the financial inside underwriting techniques. Are as frequently pointers as you have to fulfill their closure due date.

- Avoid one conclusion who does apply to the credit: cannot remove any fund or playing cards today. Wait until you next to make any larger purchases that will connect with your money.

- Rating eliminated to close off: in the event the money come in acquisition, you are going to both end up being removed to close. You will complete the down payment into the bank in addition they will work on label providers to set up the records getting the brand new closing fulfilling.

Doing home financing software will need 20 so you can two months founded on household and you may financial. During this time period, be prepared to talk to your financial daily while they sort out the latest underwriting process.

Evaluating $300K so you can Median Home prices

Shortly after all your valuable payment per month data was over as well as your money are located in order, you can examine if a mortgage on a great 300k residence is a realistic goal near you. $three hundred,000 is certainly going further in some areas as opposed to others, that can connect with your home look.

Capable in addition to help you to get pre-eligible to a mortgage loan in order to automate the method shortly after you begin considering houses

At the end of 2023, the average household price in the United States was $417,700. However, home prices vary significantly by state, city, and even neighborhood. Here are a few median home prices in a handful of sample states that display how different costs can be:

- Iowa: $205,139

- The latest Mexico: $287,752

By just considering this type of states, you can view you to a beneficial $300k home is sensible in a few elements not others. The content along with alter on the a city height. Tennessee may appear affordable, however, houses prices in the Nashville is very large as compared to rest of the state. An equivalent can probably be said to possess Portland for the Oregon compared to the other areas of area.

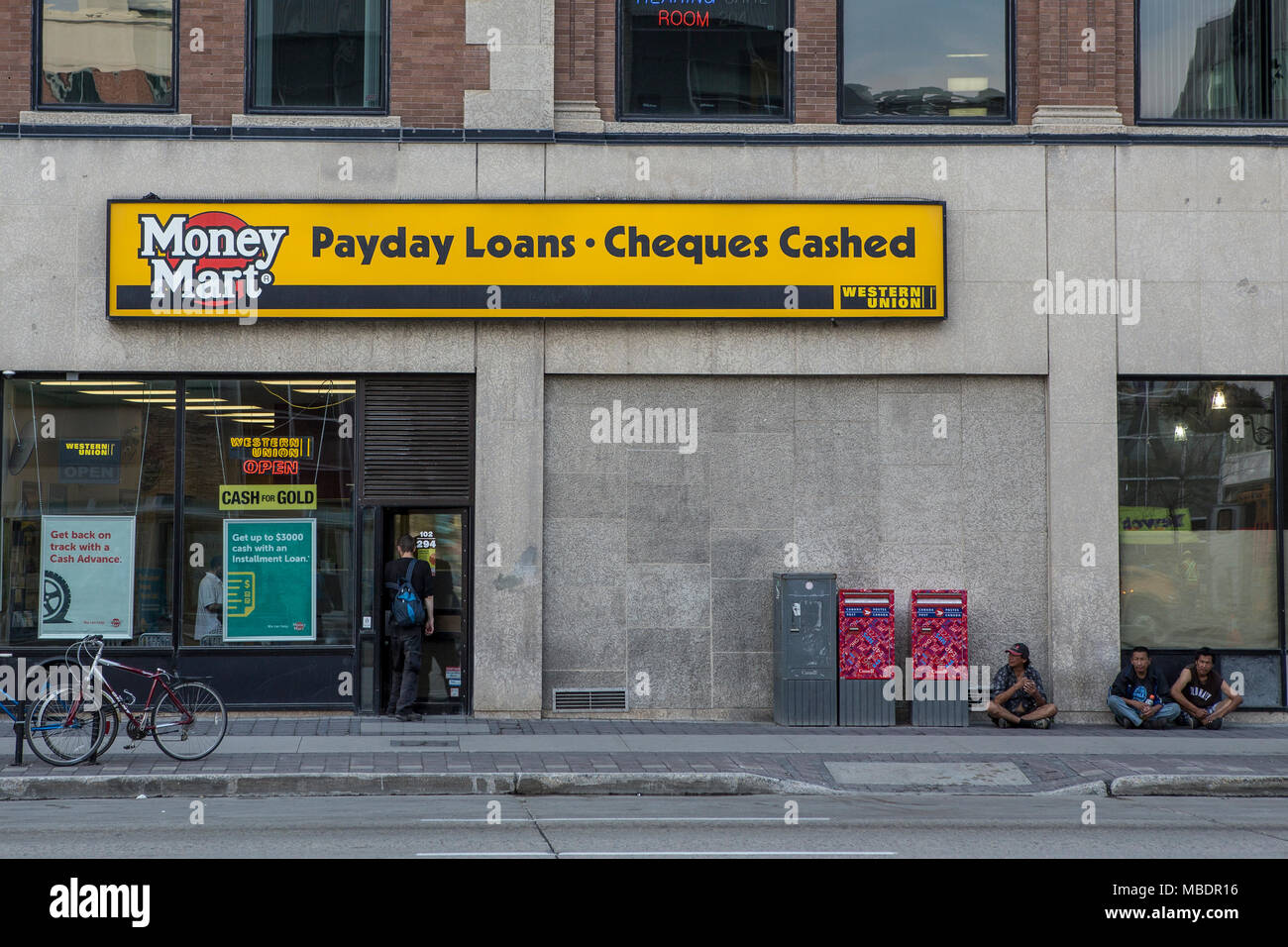

To acquire a house towards you, checklist your own need certainly to-features facilities. These are usually the quantity of bathrooms and rooms along with the spot. See what your own need services bring in observe whether budgeting getting a mortgage toward a 300k house is payday loans Idaho realistic.

If you find yourself calculating your own financial into the a beneficial 300k home is beneficial when performing our home search procedure, you don’t need to be a financial pro to find a good house. The Real estate agent makes it possible to opinion your money and guess this new version of mortgage you can afford. The agent is found on your side and ready to you from this journey.